Table of Contents

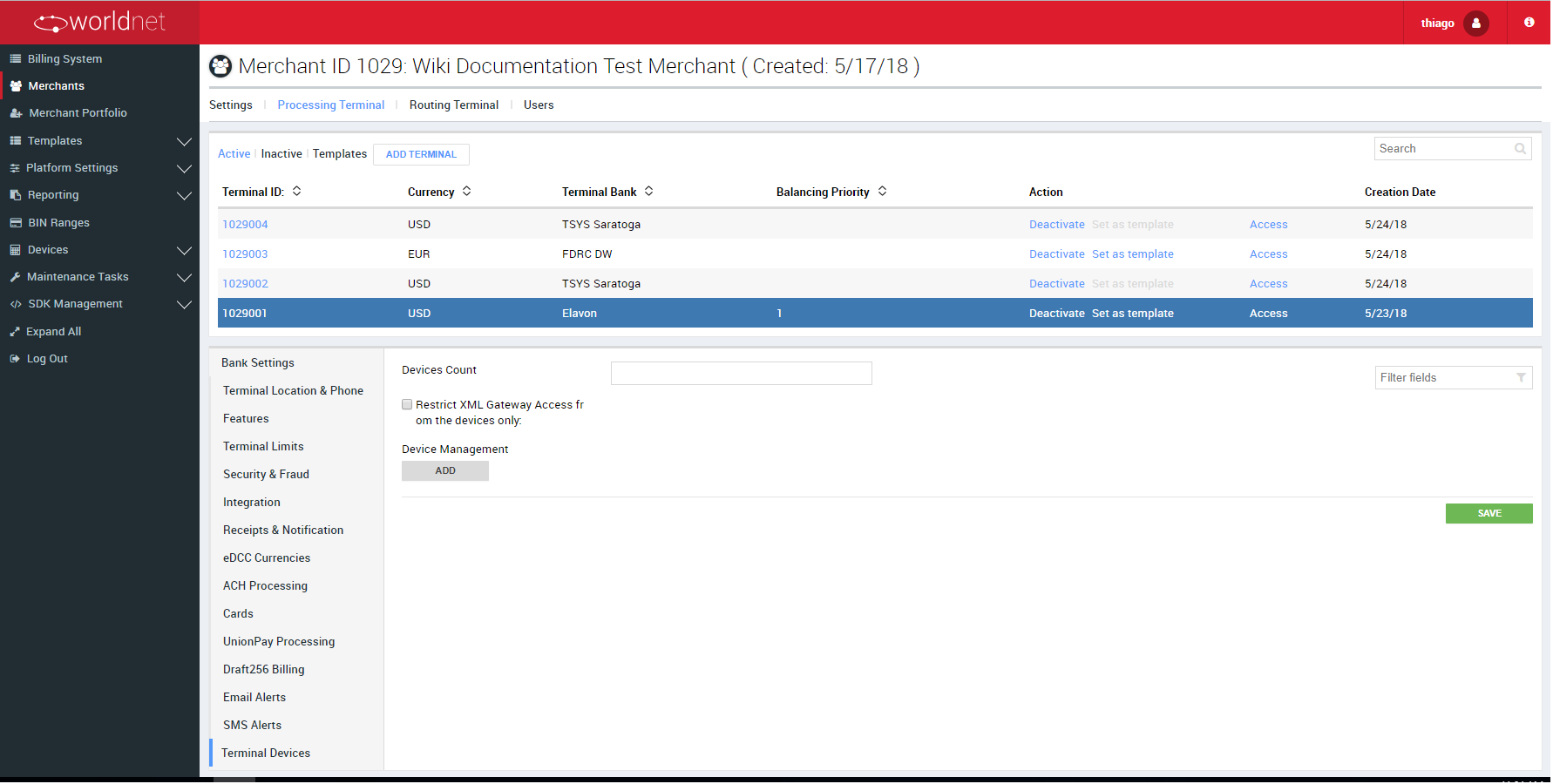

Terminal Setup

This section is focused on terminal's setup and all of its available features.

It's important to bear in mind about the settings shown on the examples of the following suc sections:

- I. In some cases, they are dependent on the Acquirer initially selected for your terminal.

- II. Some of the them are also limited by settings defined in the terminal's merchant settings - Allow PayFAC property is an example, once is configured in Merchant's Partner Portoflio, and affects one of the terminal feature settings.

- III. Some of them will appear depending on previously selected ones.

If you need more information, contact our Support Team.

General Setup

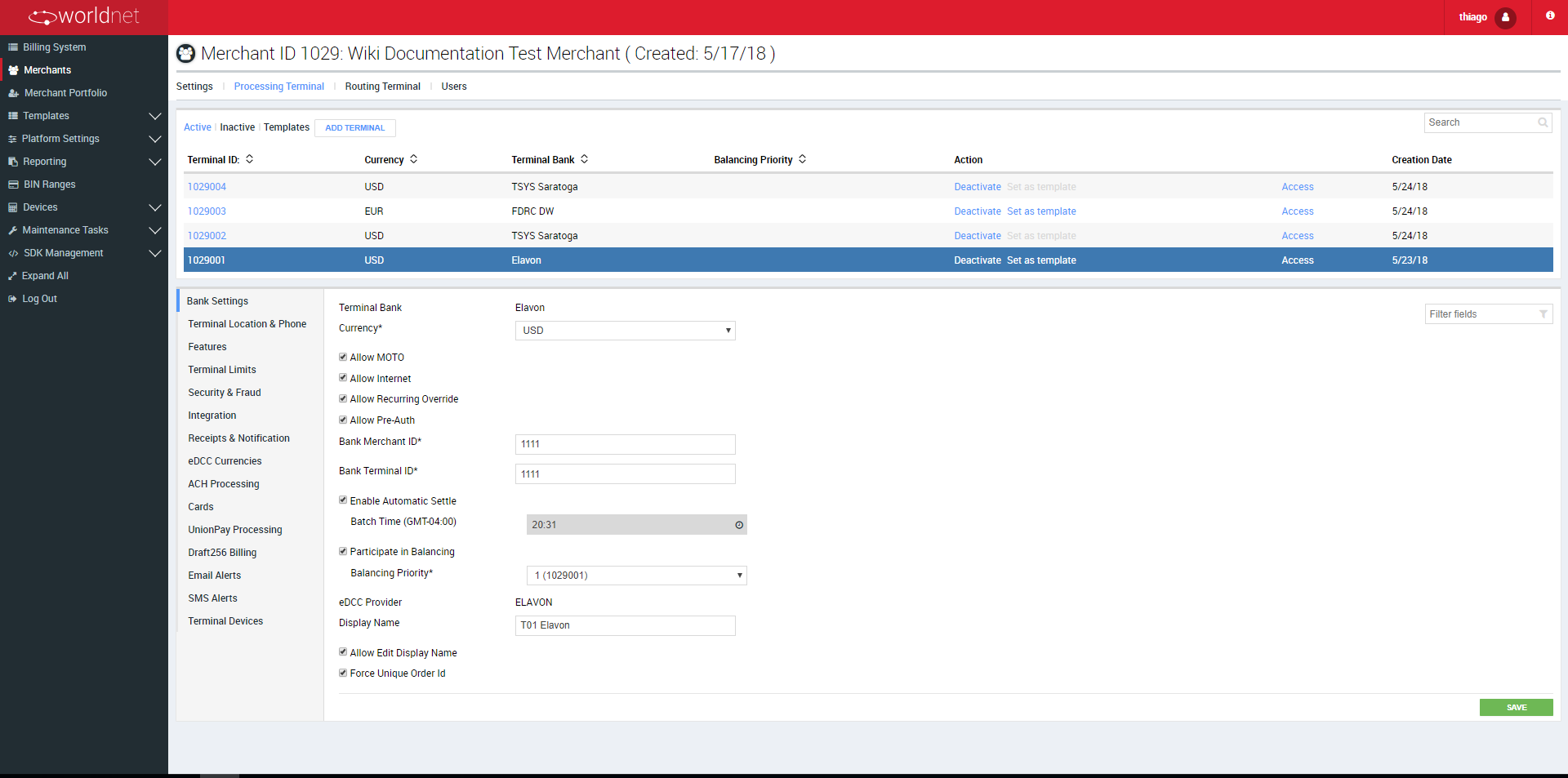

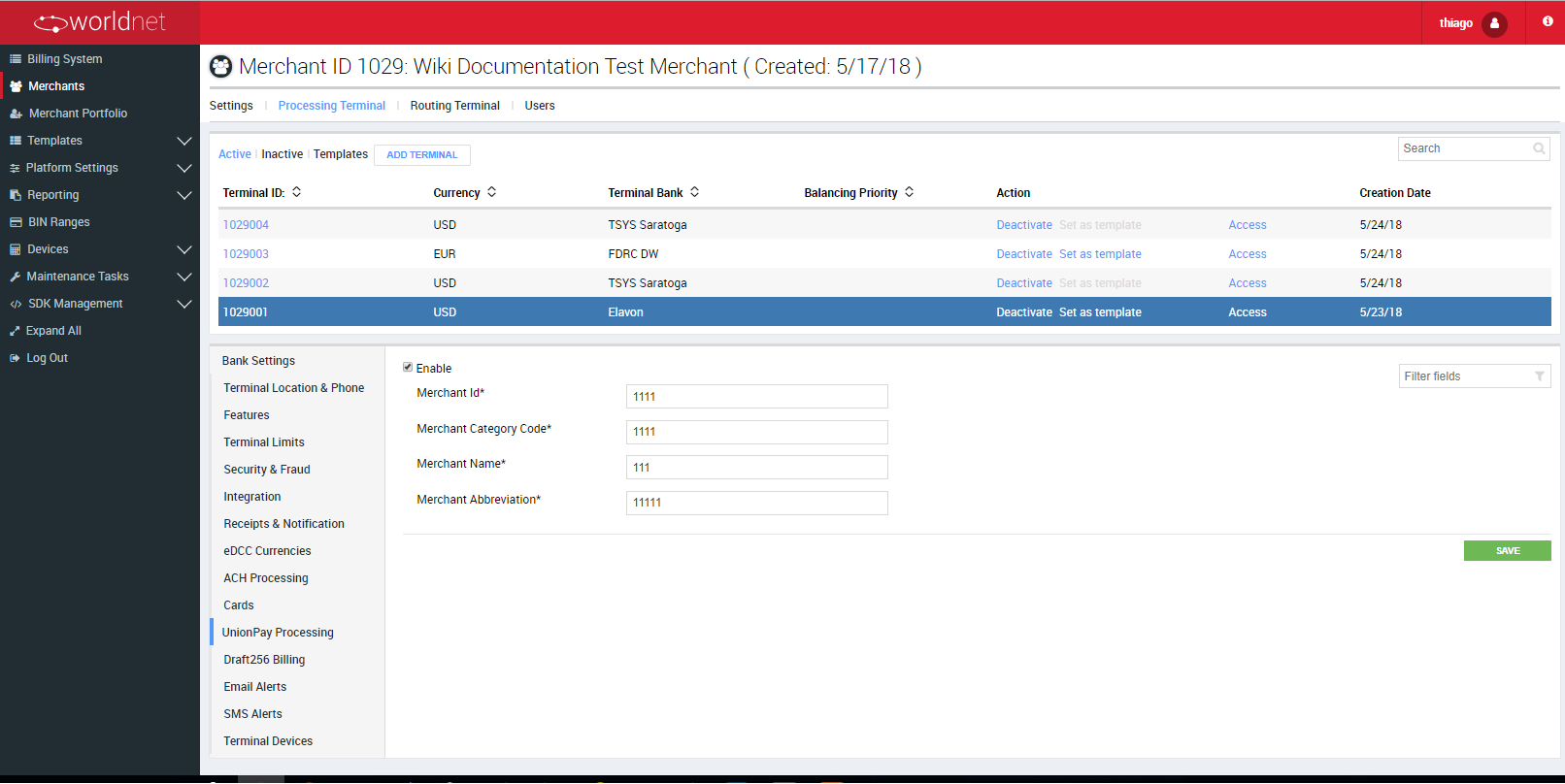

Bank Settings

| FIELD | DESCRIPTION |

|---|---|

| Terminal Number | Unique identifier of your terminal, autogenerated on creation and not editable |

| Terminal Bank/ Acquirer | Merchant Bank/ Acquirer selected on initial setup |

| Shared Secret | String used to create a digital signature - should contain alphanumeric characters |

| Currency | Transaction currency allowed for terminal and selected on initial setup |

| Allow Multicurrency | Allows the use of multicurrency procesing by the terminal |

| Allow EMCP | Allows enhanced multicurrency processingfor transactions - for more details refer to Feature Information - EMCP |

| Allow eDCC | Allows eletronic dynamic currency conversion (available for MOTO and E-Commerce terminals and only supported by Elavon bank) |

| Allow MOTO | Allows MO/TO (Mail Order/Telephone Order) transactions |

| Allow Internet | Allows internet transactions - essential for e-commerce and integrations |

| Allow CHP | Allows card holder present transactions - essential for transactions where the card data is read by card device readers |

| Allow Recurring Override | Allows automatically marking of transactions as recurring based on the transaction type informed, even if the transaction doesn't specify a recurring reference |

| Bank Merchant ID (MID) | Acquirer's Merchant ID |

| Bank Terminal ID (TID) | Acquirer's Terminal ID |

| Enable Automatic Settle | Set transactions to be settled automatically |

| Batch Time | Time of daily automatic settlement |

| Force Unique Order Id | Forces unicity in order ids within the terminal |

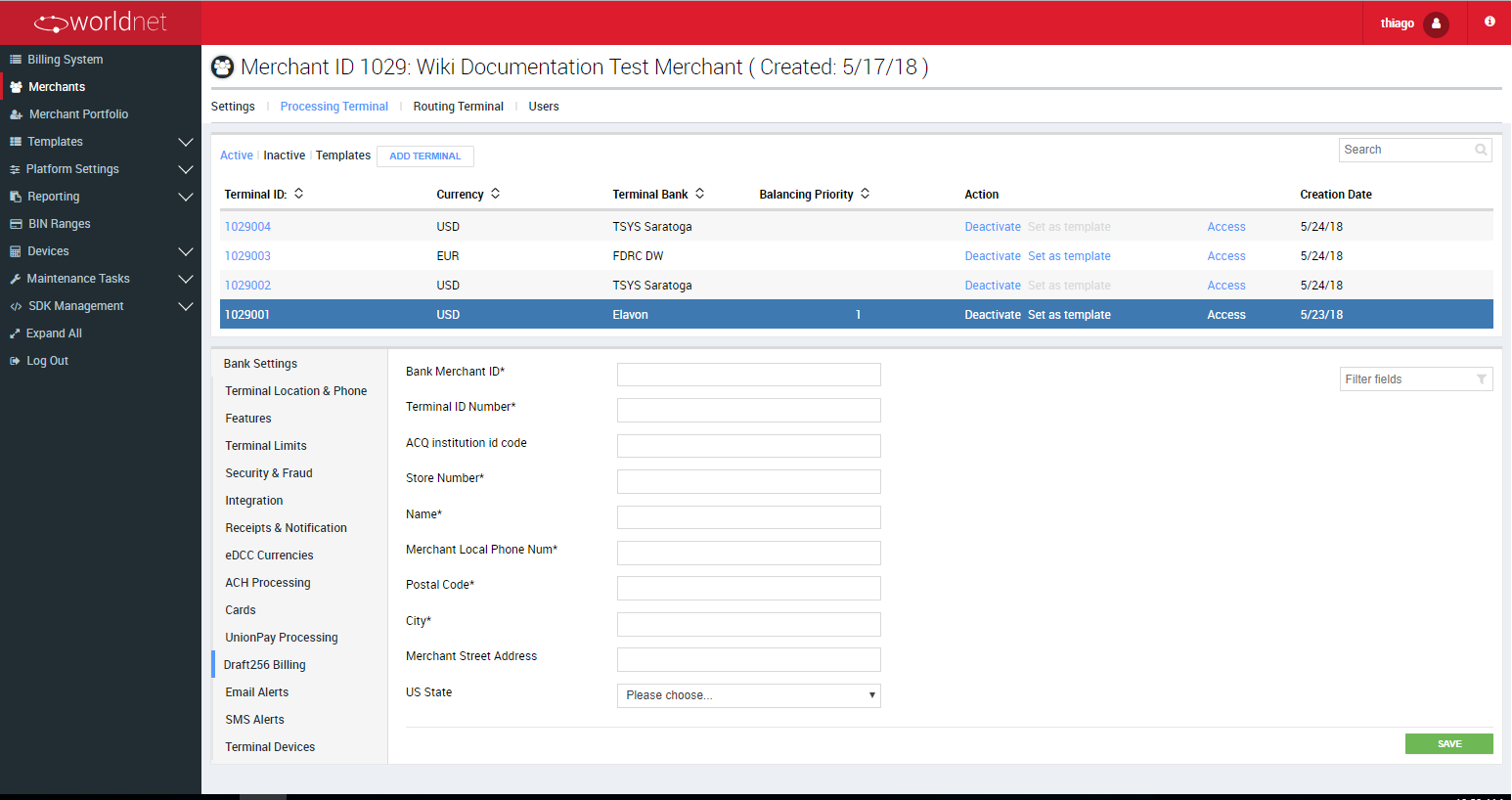

Terminal Location & Phone

| FIELD | DESCRIPTION |

|---|---|

| Name | Terminal's name |

| Merchant Local Phone Num | Merchant local phone number for the terminal |

| Postal Code | Location of the terminal - postal code |

| City | Location of the terminal - city |

| Terminal Country | Location of the terminal - country |

| Time Zone | Location of the terminal - timezone |

| Sub Merchant ID | ID to identify the submerchant using the terminal of a Pay Facilitator (PayFAC) - appears specifically when the terminal's merchant is registered under a Partner Portfolio which allows PayFAC |

| Sub Merchant Name | Name of the submerchant using the terminal of a Pay Facilitator (PayFAC) - appears specifically when the terminal's merchant is registered under a Partner Portfolio which allows PayFAC |

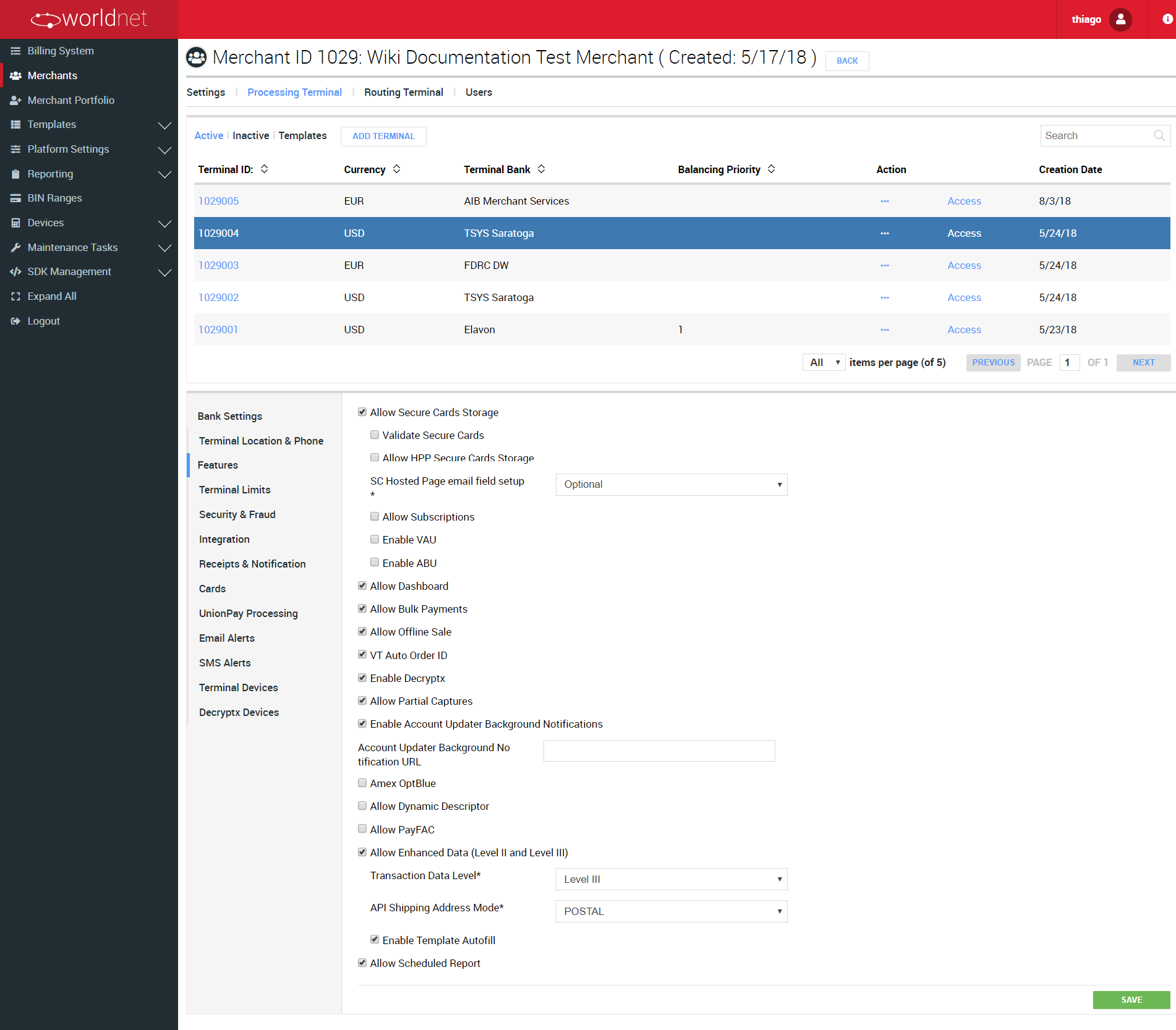

Features

| FIELD | DESCRIPTION |

|---|---|

| Allow Secure Tokens Storage | Allows Secure Token registering for recurring payments and other sub settings |

| Validate Token Security | Once enabled, requires the CVV validation for each Secure Tokens registration |

| Allow Dashboard | Allows users in SelfCare system to visualise payments' statistics |

| Allow Bulk Payments | Allows to process multiple transactions at once using a bulk file |

| Allow Offline sale | Allows the processing of offline transactions by the Virtual Terminal and using the XML Integration Method |

| VT Auto Order ID | Defines that the system shall created the Order ID for each transaction automatically |

| Enable Decryptx | Ask for further information to see if this feature is available for you |

| Allow Partial Captures | Allows the terminal to partially capture pre-authorizations |

| Allow Account Updater Background Notifications | Allows the use of performing of background notifications when the account updater feature is triggered for Secure Tokens of the terminal |

| Account Updater Background Notification URL | URL to be used as for notifications to be send to the merchant by the account updater feature |

| Amex OptBlue | Enables the possibility of using the Amex OptBlue rate options for transactions |

| Allow Dynamic Descriptor | Allows the use of Dynamic Descriptors on transactions - for a better understanding, take a look at Dynamic Descriptors - Using in XML Integration Method and Dynamic Descriptors - Terminal Setup by Merchant sections. |

| Allow PayFAC | Allows the use of PayFAC feature for processing terminal. The field is displayed only for TSYSSaratoga Acquirer when the merchant's Partner Portfolio has enabled 'PayFAC' feature |

| Allow Enhanced Data (Level II and Level III) | Allows the use of enhanced data (level 2 and level 3) for transaction processing in different channels - also depends on Acquirer support. Requires the identification of the “Data Level”, the “Shipping Address Mode” to be used with address Fields and if the Terminal should use “Template Autofill” to add enhanced data information based on an enhanced data default template. |

| Enable Google Pay | Once enabled, the Merchant ID needs to be informed. This is going to be used together with the configuration of a Certificate on your SelfCare system to enable payments using the google pay service. |

| Enable Apple Pay | Once enabled, the Store Name needs to be informed. This is going to be used together with the configuration of a Certificate on your SelfCare system to enable payments using the apple pay service. |

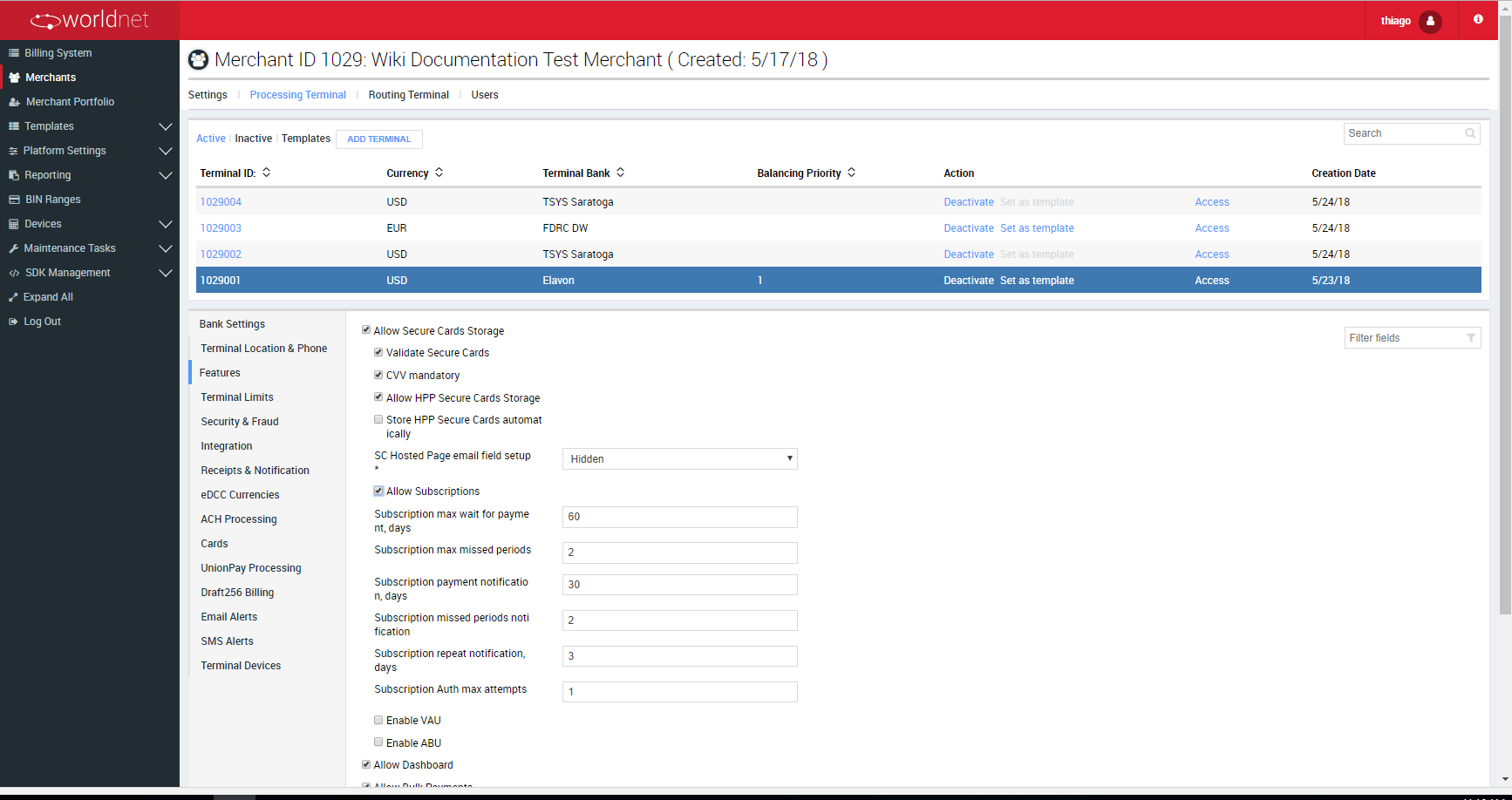

Secure Token

When Allow Secure Tokens Storage is selected, the following options are made available.

| FIELD | DESCRIPTION |

|---|---|

| Validate Secure Tokens | Requires the validation of the card account in each Token registration |

| CVV mandatory | Defines that the CVV is mandatory at each registration of a Token |

| Allow HPP Secure Tokens Storage | Enables the registration of Token for HPP |

| Store HPP Secure Tokens automatically | Configures the automatic registration of a Token when performing payments using the Hosted Page integration method |

| Token Hosted Page email field setup | Defines the behavior of the e-mail field during the Token registration using the Hosted Page integration method: Hidden, Optional or Mandatory |

| Allow Subscriptions | Enables the use of subscriptions |

| Enable VAU | Enables Visa Account Updater (VAU) for the terminal |

| Card Updater Type | When VAU is enable, it's necessary to inform the updater service to be used |

| VAU Merchant ID | When VAU is enable, it's necessary to inform the merchant's id to use the VAU service |

| Enable ABU | Enables Mastercard Automatic Billing Updater (ABU) for the terminal |

| Card Updater Type | When ABU is enable, it's necessary to inform the updater service to be used |

| ABU Merchant ID | When ABU is enable, it's necessary to inform the merchant's id to use the ABU service |

Subscriptions

When Allow Subscriptions is selected, the following options are made avialable.

| FIELD | DESCRIPTION |

|---|---|

| Subscription max wait for payments, days | Subscription is marked as suspended if payment was not received after the specified days number |

| Subscriptions max missed periods | Subscription is marked as suspended if paid periods count is less for a set value than expected |

| Subscriptions payment notification, days | Number of days after which first warning notification about not paid subscription will be sent |

| Subscription missed periods notification | Warning notification will be sent if actual paid periods is less for an specified number than expected paid periods |

| Subscription repeat notification, days | Number of days passing which repeat notification is sent |

| Subscription Auth max attempts | Subscription is marked as suspended if payment was not successful after specified attempts number |

The subscriptions' fields already appear defined with default values, which can be modified, but we recommend you to consult with our Support Team before any changes.

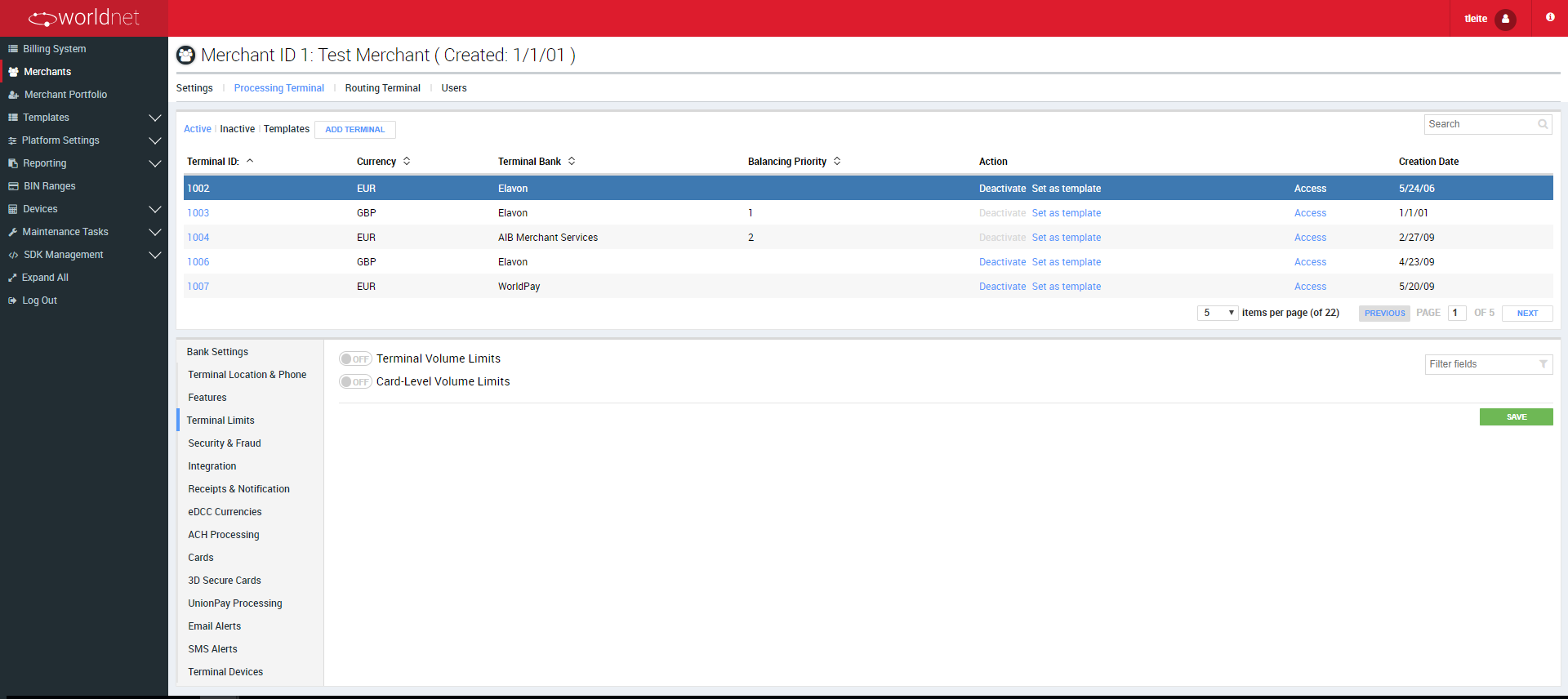

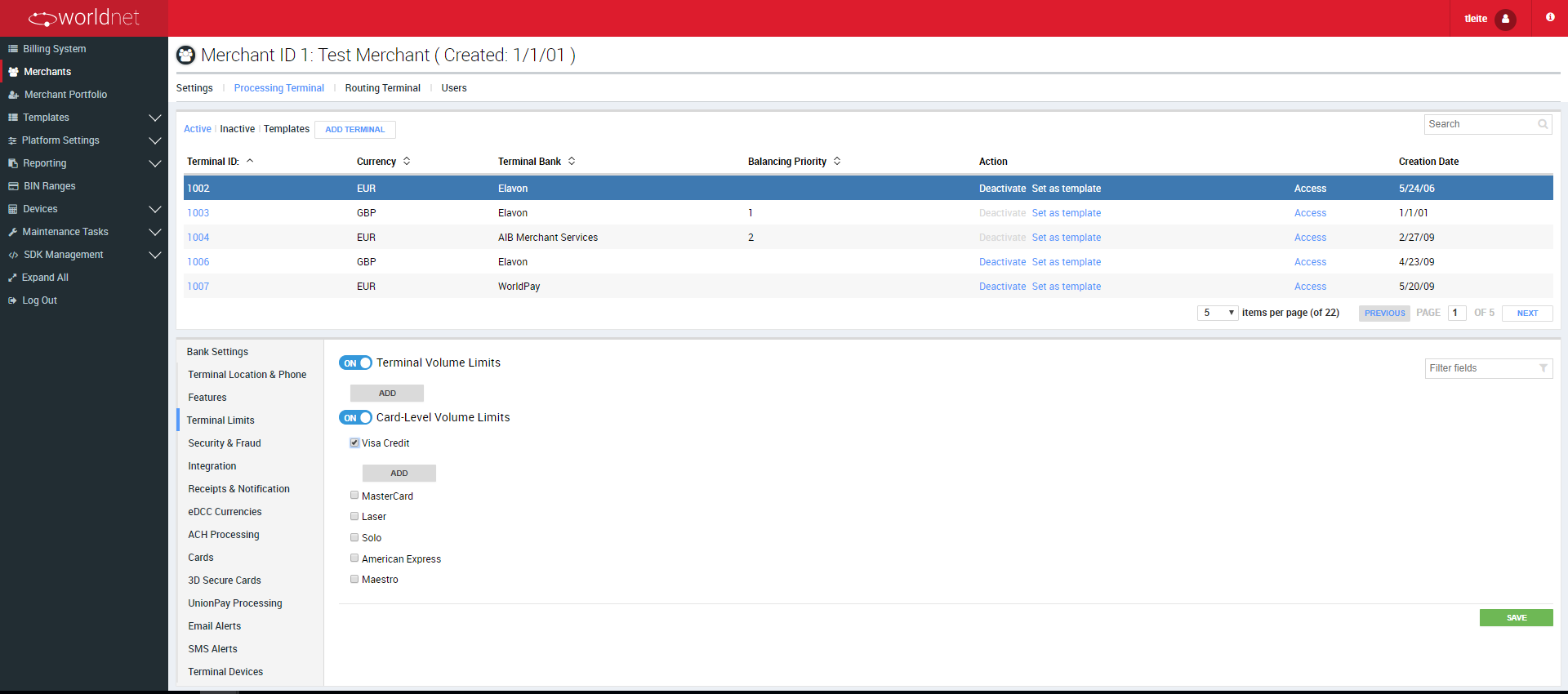

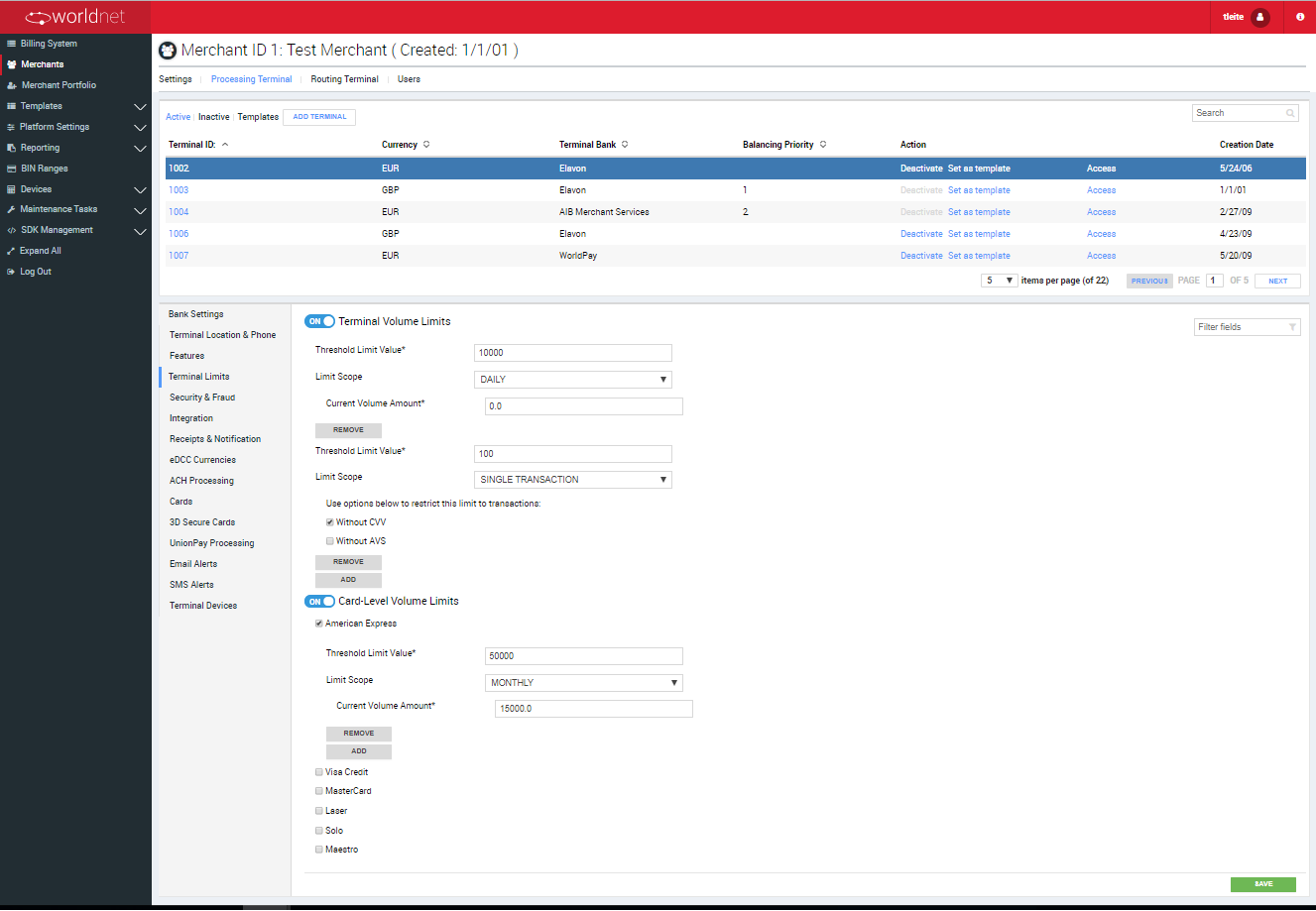

Terminal Limits

This feature allows to configure for a Merchant the use of specific rules to limit transactions.

As you can see in the previous image, the limits can be defined for two limit configurations:

- Terminal Volume Limits: Limit applied to the whole set of transactions processed by the Terminal.

- Card-Level Volume Limits: Limit applied to the subset of transactions processed by the Terminal, for a specific card brand.

The Terminal Level configuration for transaction limits allows more flexibility when defining those limits than the Merchant Level.

The Terminal Limits feature working in consonance with the same configuration, present at the Merchant Details section of the Merchant configuration.

The limits work the same way, for both terminal and card configurations, but a few elements need to be informed to register a limit, depending on the scope used.

The scope (DAILY, MONTHLY, SINGLE TRANSACTION) defines how the limit is going to be applied to the transactions, like:

- 1 - If selected DAILY: The limit verification will consider the total volume amount of transactions performed within the day, to the given configuration. In this scope you need to inform:

- Threshold Limit Value: Applied to every scope, this field defines the limit itself.

- Limit Scope: DAILY

- Current Value Amount: Applied only for DAILY and MONTHLY scopes, it's the current accumulated value for limit comparison - the calculation of the limit, in each transaction, adds to this value to keep the track of the limit.

- Daily limits accumulate the terminal's total authorized amount (Current Value Amount) within the current day, and the value is reset when the day changes. A monthly limit is considered reached when the volume hits 98% (not configurable) of its threshold.

- 2 - If selected MONTHLY: The limit verification will consider the total volume amount of transactions performed within the month, to the given configuration.

- Threshold Limit Value: Applied to every scope, this field defines the limit itself

- Limit Scope: MONTHLY

- Current Value Amount: Applied only for DAILY and MONTHLY scopes, it's the current accumulated value for limit comparison - the calculation of the limit, in each transaction, adds to this value to keep the track of the limit

- Monthly limits accumulate the terminal's total authorized amount (Current Value Amount) within the current month, and the value is reset when the month changes. A monthly limit is considered reached when the volume hits 98% (not configurable) of its threshold.

- 3 - If selected SINGLE TRANSACTION: The limit verification will consider the amount of each transaction performed, to the given configuration.

- Threshold Limit Value: Applied to every scope, this field defines the limit itself

- Limit Scope: SINGLE TRANSACTION

- Without CVV: Applied only to SINGLE TRANSACTION scope, this field establishes that the limit is only applied to transactions without CVV

- Without AVS: Applied only to SINGLE TRANSACTION scope, this field establishes that the limit is only applied to transactions without AVS

LIMIT HIERARCHY APPLICATION

The limits have a particular hierarchy to be considered.

- When Defining Volume (DAILY/ MONTHLY) Scope Limits : The Payment gateway always considers the thresholds of the volumes for the three possible elements, from the lower to the higher one in the hierarchy - CARD TYPE (if defined » TERMINAL (if defined) » MERCHANT (if defined). If any of them is reached, the constraint is applied.

- When Defining Single (SINGLE TRANSACTION) Scope Limits : The Payment Gateway only considers the most specific threshold for the three possible elements, following the order - CARD TYPE » TERMINAL » MERCHANT.

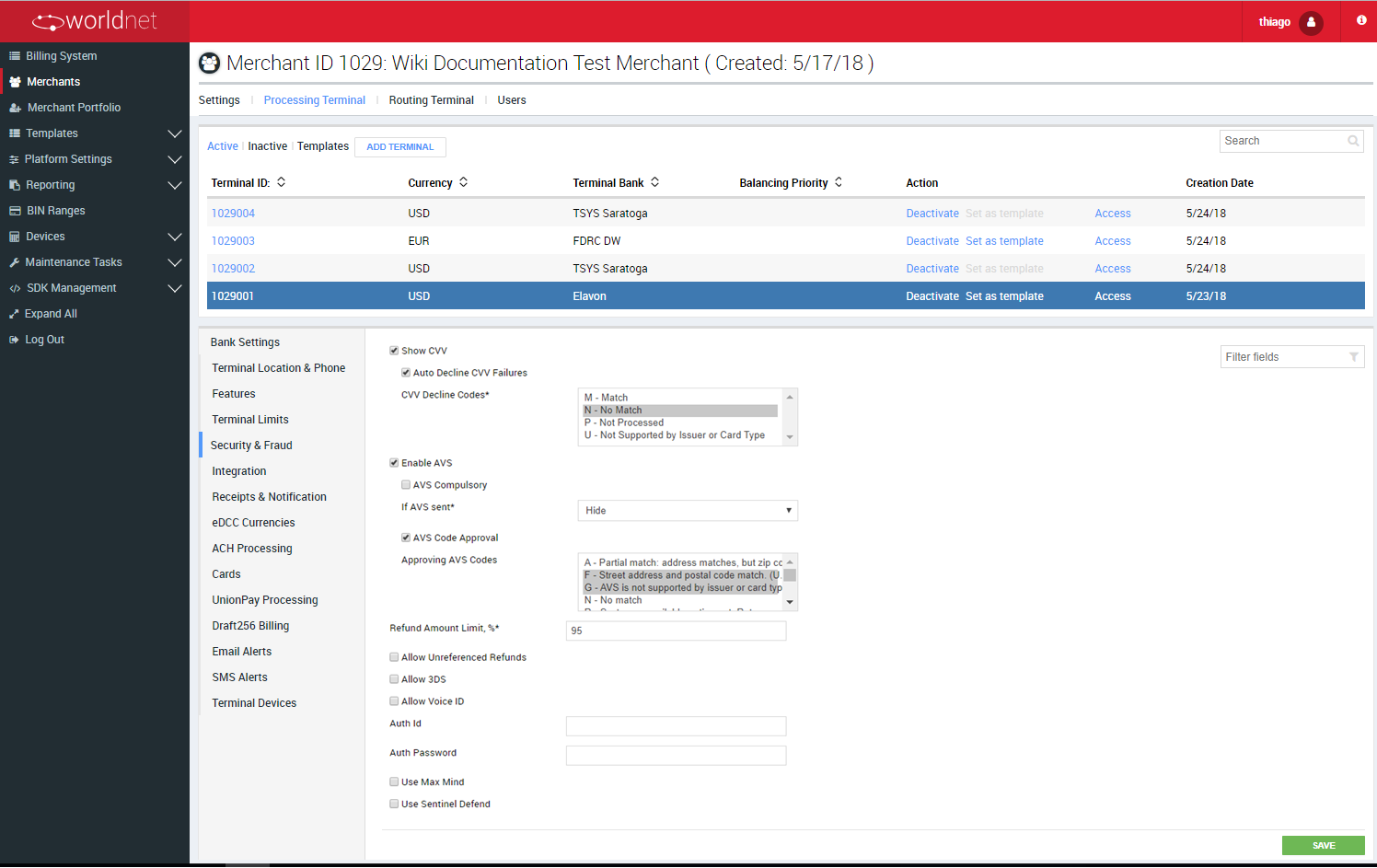

Security & Fraud

| FIELD | DESCRIPTION |

|---|---|

| Show CVV | CVV will be required when processing a transaction . |

| Auto Decline CVV | Allows to choose which CVV responses should be considered to decline a transaction. |

| CVV Decline Codes | Once Auto Decline CVV is selected, the list of possible responses will be shown in this field. The options selected here will be used to automatically decline any transactions which result in them when the CVV verification is performed. |

| Enable AVS | If this option is checked, the AVS is enabled and two more options will be shown: AVS Compulsory (check field) and If AVS sent (list of options). This setting, when enabled, will show three address fields at the Virtual Terminal and at the Hosted Payment Page – Street, City and Postcode – so the cardholder can provide a card billing address, but that is not mandatory. |

| AVS Compulsory | When selected, this option enables a new field API AVS Type, and ensures that before finishing a transaction cannot be processed without filling in the address fields. |

| API AVS Type | This field defines a configuration for the execution of AVS in API integrations – REST, XML and HPP. Depending on the value selected, the AVS will consider a specific set of fields to be sent to the bank for validation. - Exact: The fields shown and expected are all three. - Postal: The only field shown and expected is Postcode. |

| If AVS sent | This field defines a configuration for the Hosted Payment Page (HPP). When an application integrated to a HPP already has the cardholder’s billing address, it’s possible to send this data to the HPP and selecting one of the options in this field you can: - Hide – selecting “Hide”, the HPP is going to use the address internally on the AVS, but the data is not going to be shown on the HPP. - Display – selecting “Display”, the address receive by the HPP will be shown and used to execute the AVS, but It’ll not be editable by the user. - Editable – selecting “Editable”, the address receive by the HPP will be shown and used to execute the AVS, but the user will be able to edit the fields before submiting the payment. |

| AVS Code Approval | Allows to choose which AVS response codes should be considered to approve a transaction. |

| Approving AVS Codes | This list presentes the possible AVS response codes (and description). Depending on the values selected, the terminal is going to consider a transaction approved, if its AVS response code matches any option selected. |

| Refund Amount Limit | By default it is set to 100% |

| Allow Unreferenced Refunds | Refund transaction with more than 100% |

| Limit | Unreferenced limit |

| Allow 3DS | Allow 3D Secure into account |

| FAC MID | If 3D Secure is enabled, enter MID provided by FAC |

| FAC Password | If 3D Secure is enabled, enter Password provided by FAC |

| Allow Voice ID | Legacy feature - no longer available |

| Auth ID | Legacy feature - no longer available |

| Auth Password | Legacy feature - no longer available |

| Use Max Mind | Contact Support Team to check if this option is available for you |

| Use Sentinel Defend | Contact Support Team to check if this option is available for you |

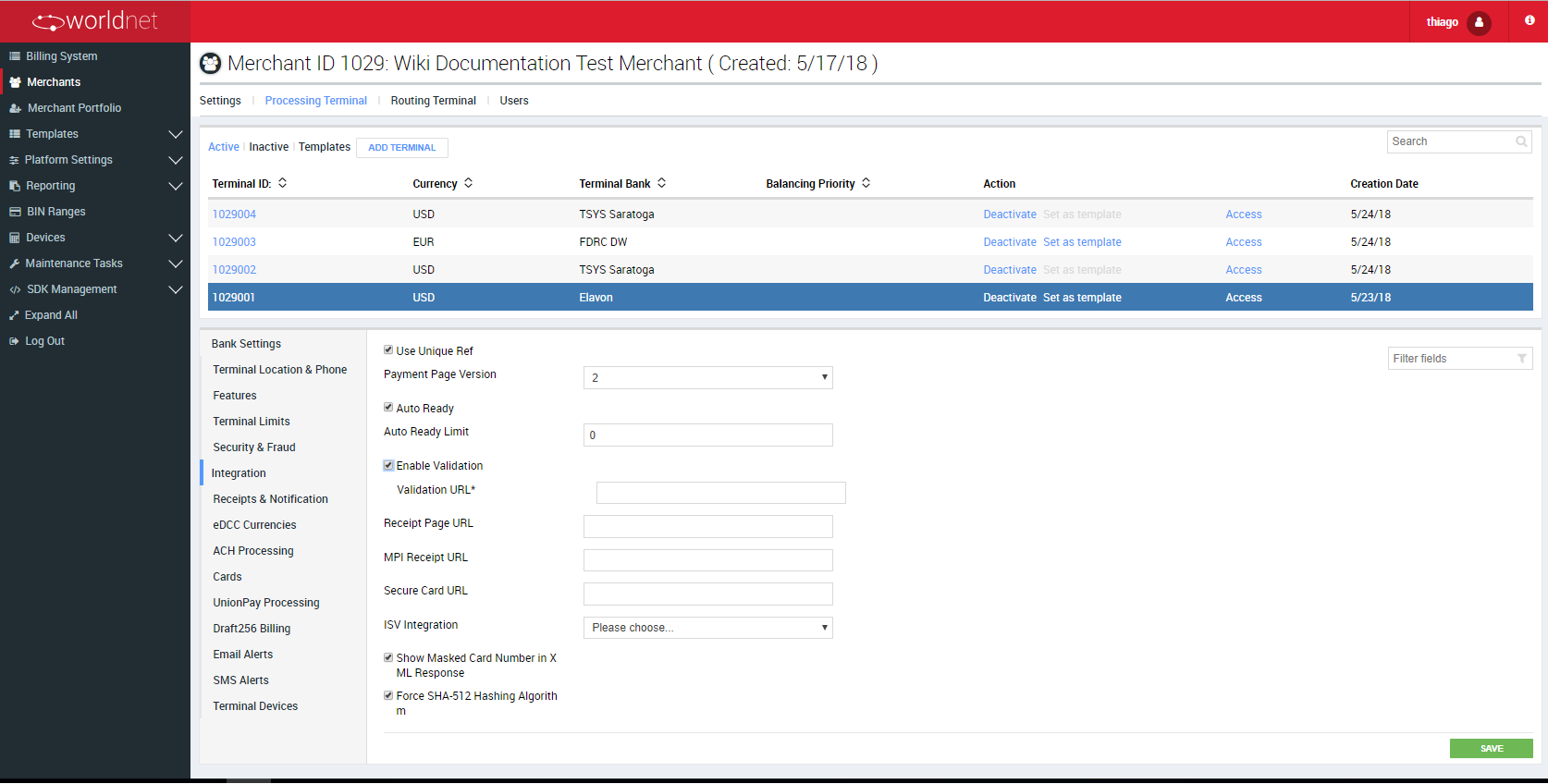

Integration

| FIELD | DESCRIPTION |

|---|---|

| Use Unique Ref | By default it will create Unique Ref for each transaction. When enabled you will receive the unique ref back in the response for XML |

| Payment Page Version | Templates for Payment Page |

| Auto Ready | If enabled, all transactions will go to “ready” status and if disabled all transactions will go to “pending” status and will require manual approval |

| Auto Ready Limit | If the limit is set, all transactions above the limit will be set as “pending” and will require a manual approval |

| Enable Validation | Enable background validation |

| Validation URL | If background validation is enabled, enter URL |

| Receipt Page URL | URL for receipt page |

| MPI Receipt URL | URL for MPI receipt page |

| ISV Integration | Field to associate the terminal to a specific ISV Integration registered, as a tracking alternative for transactions in ISV partnerships |

| Secure Token URL | URL for Secure Token |

| Secure ACH Account URL | Contact Support Team to check if this feature is available for you |

| Include Bank response code in XML | Defines if the gateway should include the original bank response in responses provided by the XML Integration method |

| Include Masked Card Number in XML Response | Defines if the gateway should provided the transaction's card (masked) in responses provided by the XML Integration method |

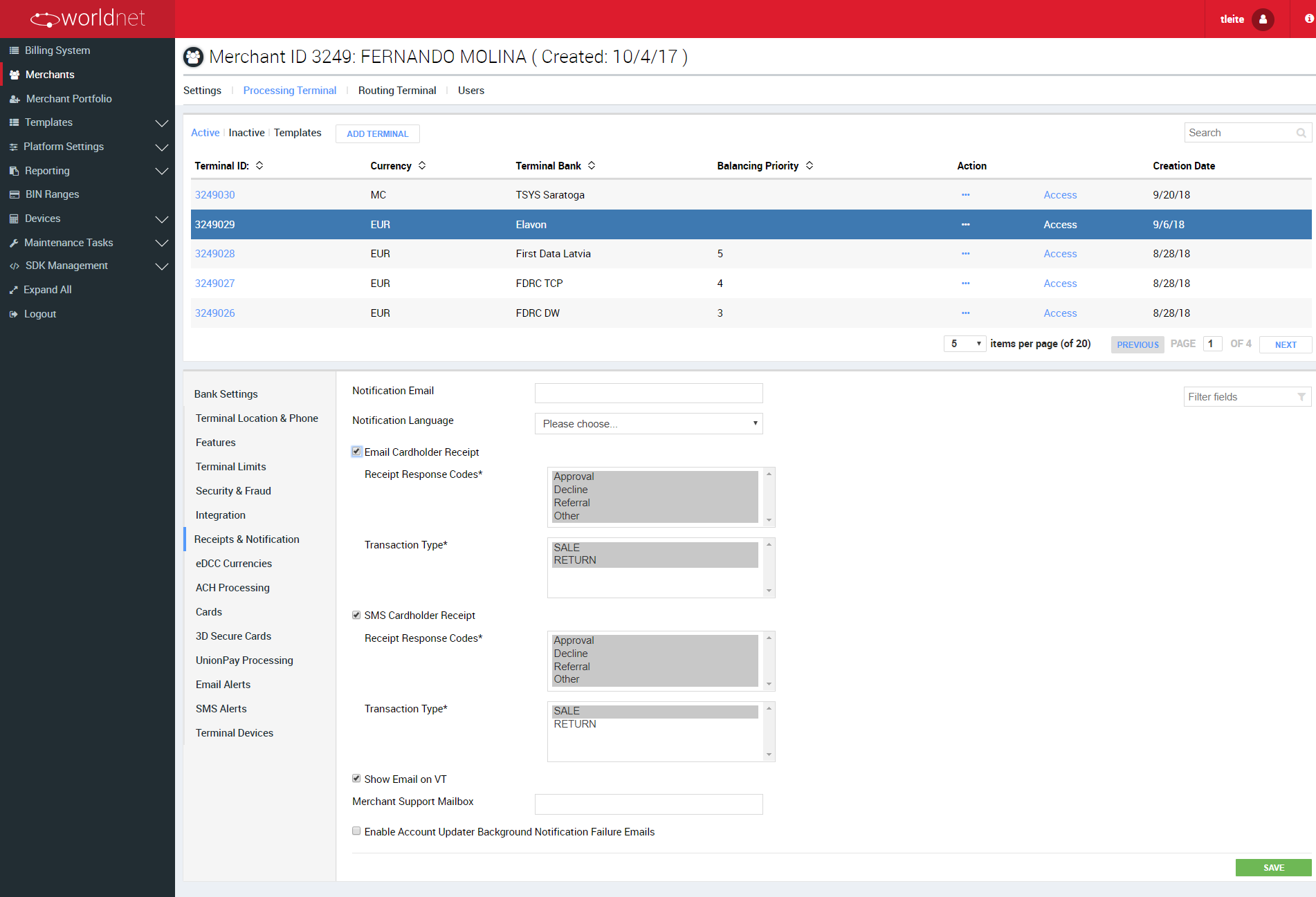

Receipt & Notification

| FIELD | DESCRIPTION |

|---|---|

| Notification Email | If this option is selected, a notification email will be sent for all transactions |

| Notification Language | The terminal uses the language defined here as default for receipts' printing and notifications. |

| Cardholder Receipt | If this option is selected, a receipt will be sent to cardholders. |

| Receipt Response Codes | Select receipts for all transactions: approval, decline, referral and others. |

| Show Email on VT | If this option is selected, email address will be require to process transactions on Virtual Terminal. |

| Merchant Support Mailbox | Partners must enter their support Email address here. |

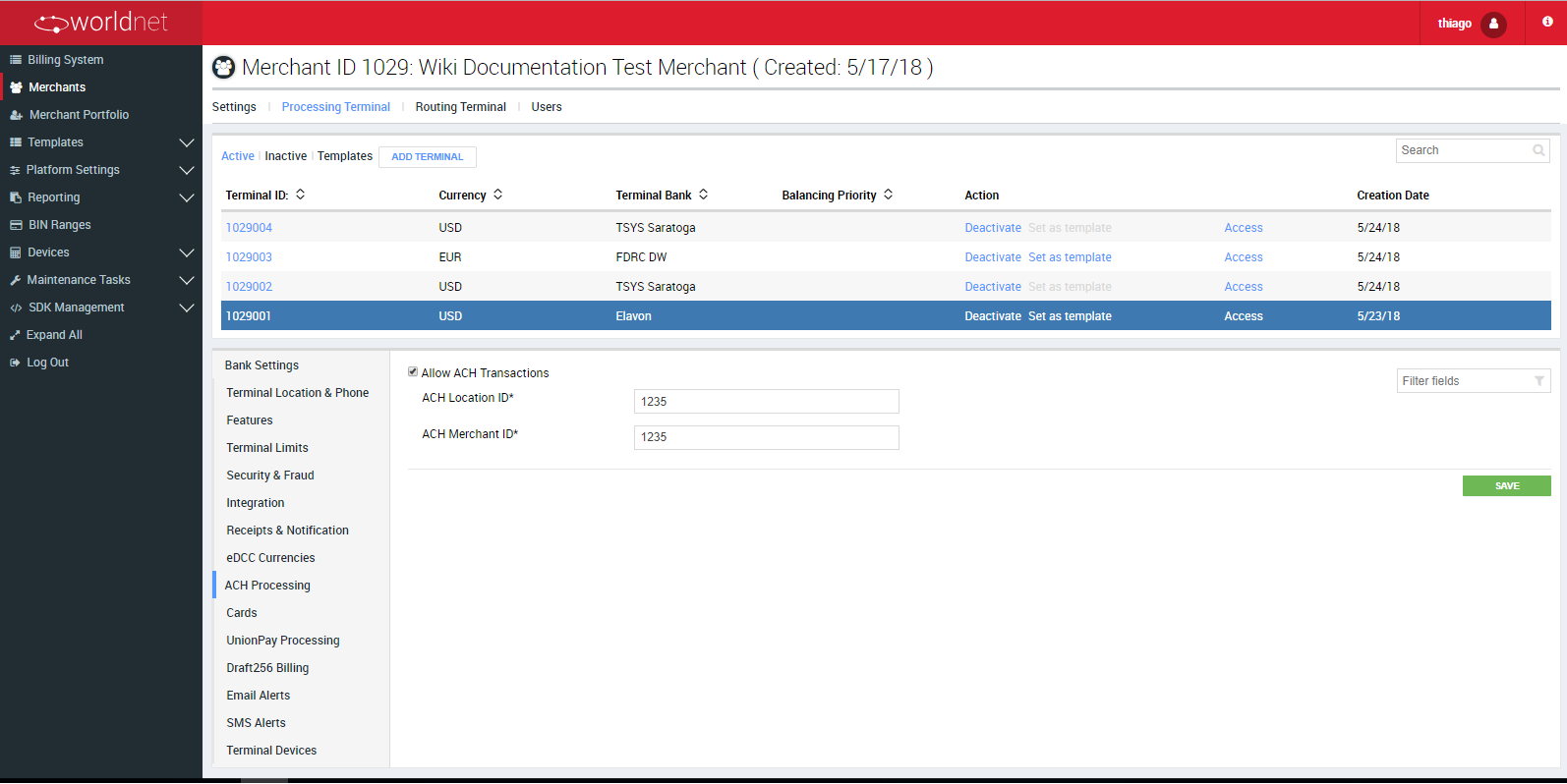

ACH Processing

Contact Support Team to check if this option is available for you and to understand how to configure it.

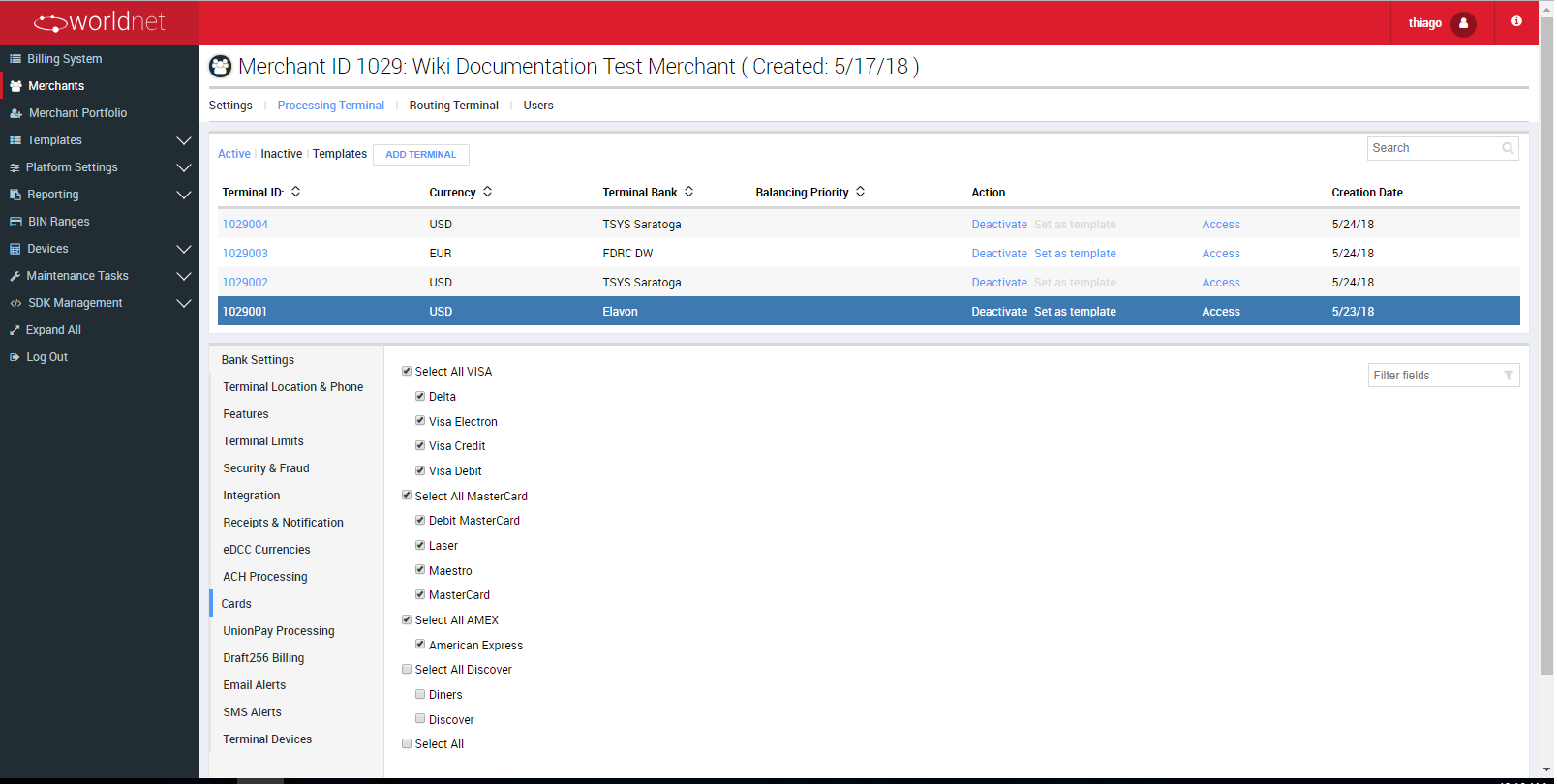

Cards

In this section you have to select all the card brands which will be accepted by the terminal to process transactions.

UnionPay Processing

Contact Support Team to check if this option is available for you and to understand how to configure it.

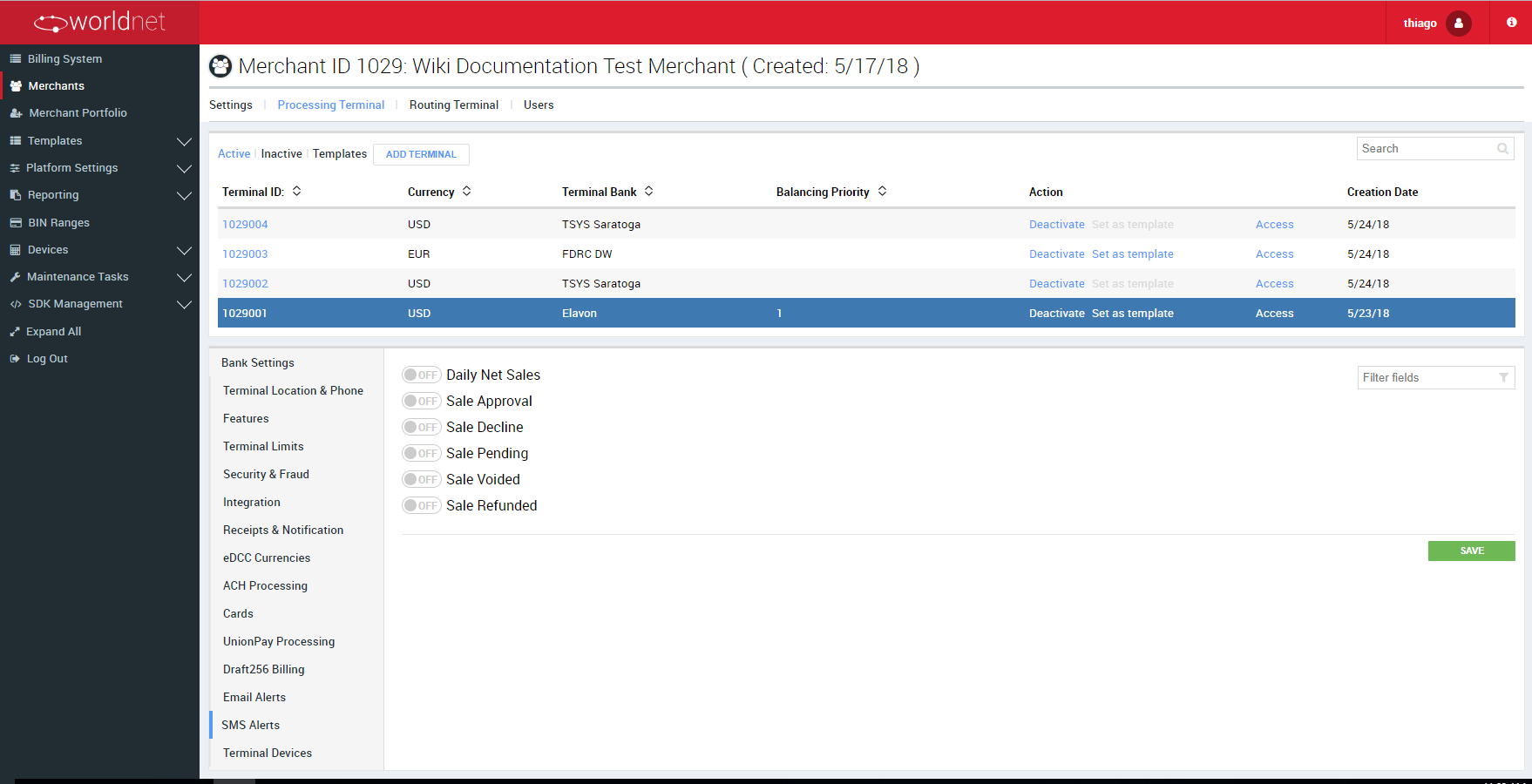

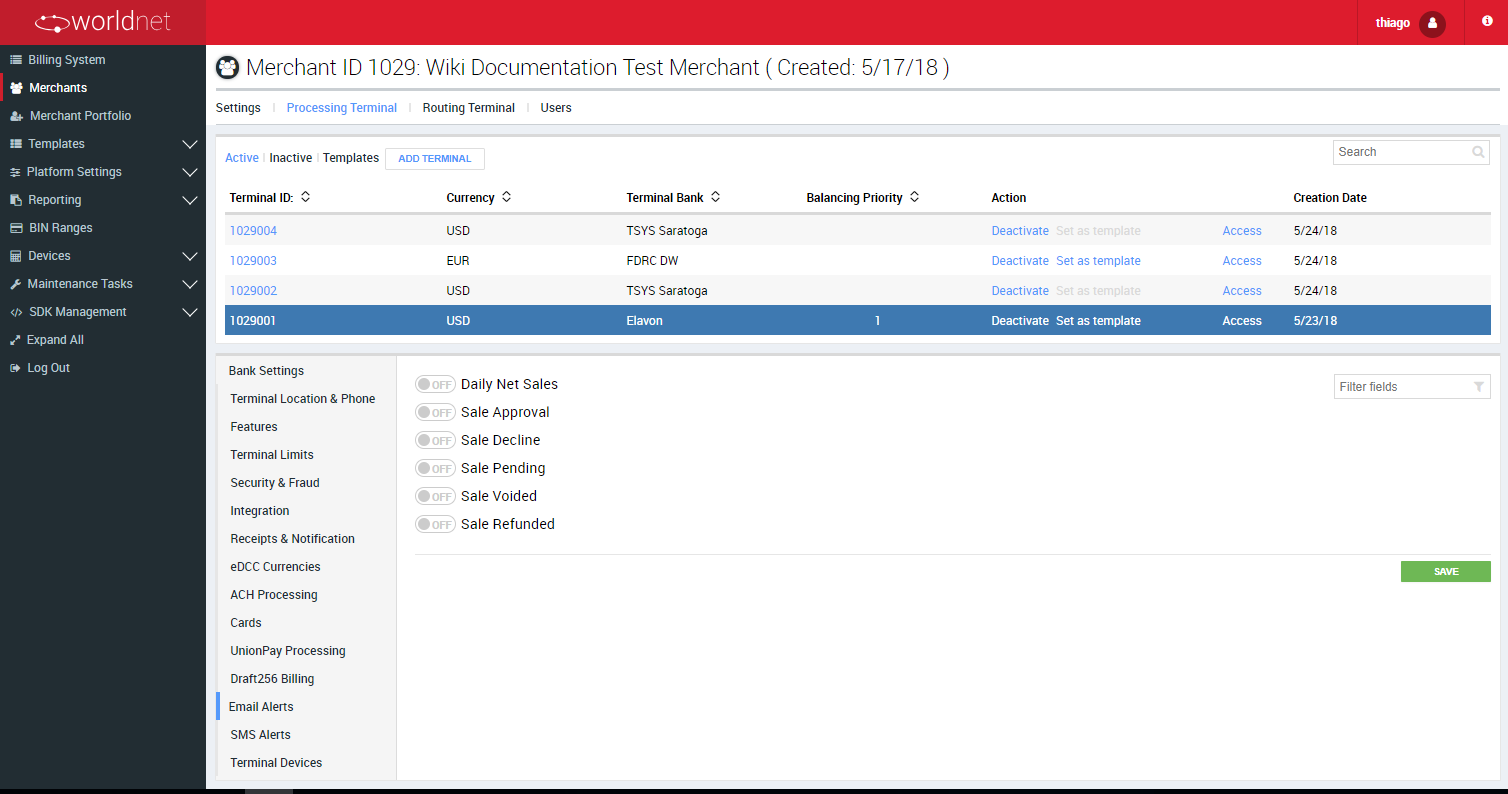

Email or SMS Alerts

| FIELD | DESCRIPTION |

|---|---|

| Daily Net Sales | If this option is selected, a notification email or SMS will be sent according to selected criteria for daily sales |

| Sales Approval | If this option is selected, a notification email or SMS will be sent according to selected criteria for approval transactions |

| Sale Declined | If this option is selected, a notification email or SMS will be sent according to selected criteria for declined transactions |

| Sale Pended | If this option is selected, a notification email or SMS will be sent according to selected criteria for pended transactions |

| Sale Voided | If this option is selected, a notification email or SMS will be sent according to selected criteria for voided transactions |

| Sale Refunded | If this option is selected, a notification email or SMS will be sent according to selected criteria for refunded transactions |

SMS Alert Setup

E-mail Alert Setup

Terminal Devices

Contact Support Team to check if this option is available for you and to understand how to configure it.

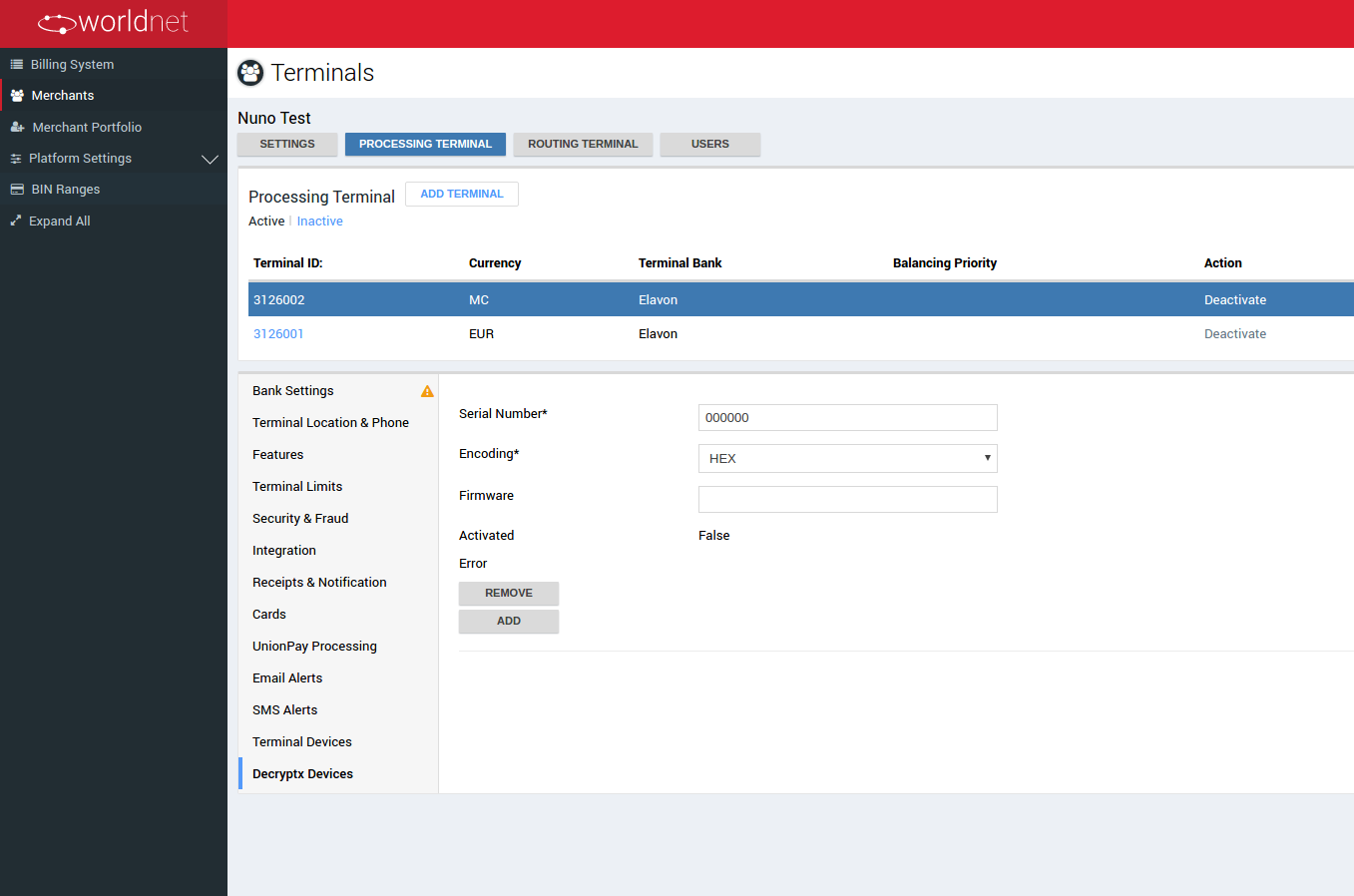

Decryptx Settings

Contact Support Team to check if this option is available for you and to understand how to configure it.